We have to recognise that inciting threat and imminent danger is an element of the hybrid war we have been living in for many decades. It is a psychological operation whose impact must be deterred by educating, explaining and comforting, not by amplifying the sense of danger. This is especially so since the actual state of mind of the people, following various studies and data, indicates neither fear nor despair.

But it is well worth setting aside our emotions and exploring the many examples around the world. There are examples even in Europe such as Belfast, the capital of Northern Ireland, or Nicosia in Cyprus, the world’s last divided capital.

Belfast has been relatively peaceful since the Good Friday Agreement in 1998. However, there are tensions to this day, and at certain times, there is turmoil over issues of sovereignty, national identity and political integration. However, the city is nevertheless expanding, with a relatively high demand and supply of housing, and prices are rising moderately but steadily.

The situation is even more intense in Nicosia: the northern part of the city and the island are controlled by the Turkish Republic of Northern Cyprus, which is recognised by Turkey only, with the southern part controlled by Greece. As a result, the city is in a constant state of tension. But the southern part of the city is vibrant, with many tourists and foreign investment, and the demand and prices for housing are constantly on the rise.

Similarly, Kyiv, which needs no introduction, has not only felt directly threatened by the 2014 occupation of Crimea and parts of the eastern territories of Ukraine, but has also been in a natural state of war. However, the capital was a fast-growing city until the large-scale Russian invasion of 2022, even though the security situation was not remotely comparable to Lithuania. As the westward orientation started to boost the economy, demand for housing – along with prices – also skyrocketed. There was no shortage of large and ambitious real estate projects in the city, and people were eager to buy new properties.

A while ago, the best examples were highlighted at a business event although geographically, they are pretty distant from Lithuania. These are Tel Aviv in Israel and Seoul in South Korea. Although Tel Aviv is not the capital, I have seen this city mentioned several times, so let’s have a closer look at both cities.

Tel Aviv: in the whirlwind of threats – one of the most expensive cities in the world

Despite living in constant confrontation with the Palestinians and other Arab states since the establishment of the State of Israel after World War II, Tel Aviv has become one of the most desirable and prestigious cities in the world. It has a high demand for housing, driven by its status as a technology hub, the overall strength of the Israeli economy, high birth rates and immigration. This demand, combined with the limited supply, has resulted in high property prices, which has made Tel Aviv one of the most expensive cities in the region and Europe. The city’s dynamic economy and cultural appeal also attract significant foreign investment in real estate. This has boosted the market considerably, despite the uncertainty in the region.

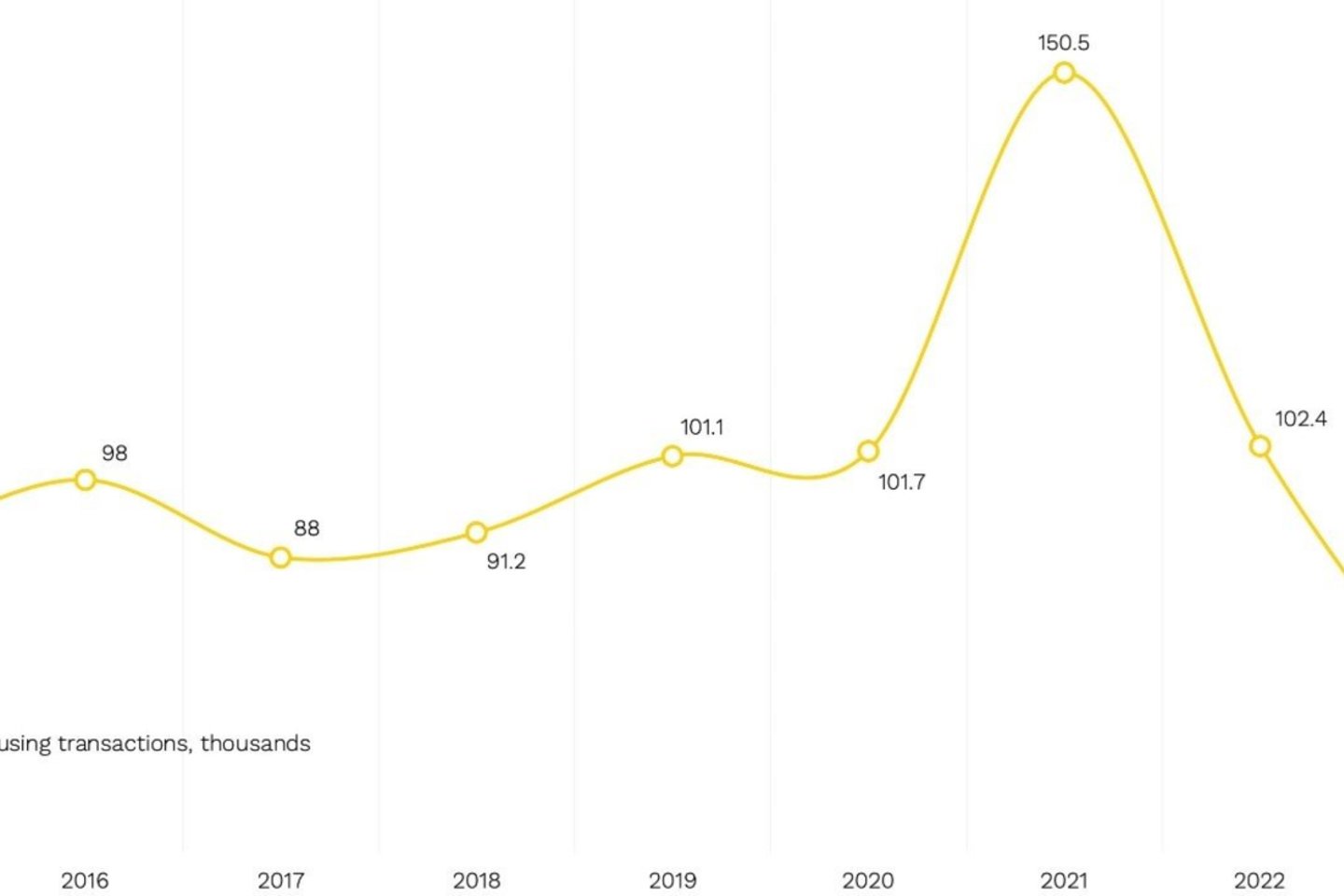

The market figures there are impressive: based on data compiled by Citus analysts, the number of new residential acquisitions in the Tel Aviv region, which has a population of around 1.5 million, reached 5,500 per year in 2018 and jumped to 13,000 in 2021. However, in 2022 – like in Lithuania – demand decreased by around 40%. The same global macroeconomic levers are at work here.

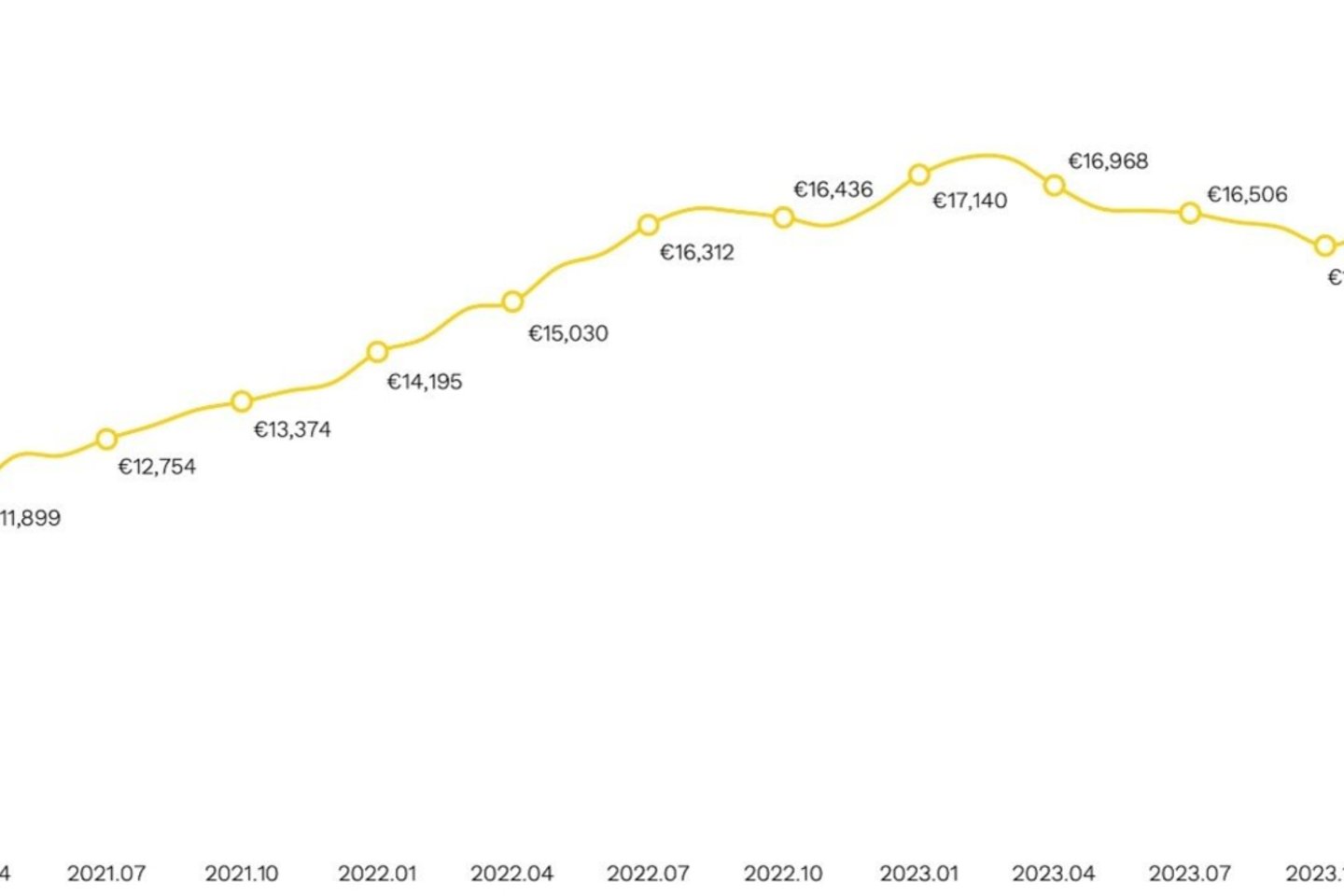

Prices in Tel Aviv were steady despite the decrease in the number of transactions. And they are equally impressive. The highest prices were recorded at the end of February 2023, when they reached EUR 17,500/sqm! Prices have been rising steadily, fluctuating similarly over the last 12 months. According to the latest available data, in February of this year they were close to EUR 16,000/sqm.

The average monthly salary for a Tel Aviv resident is around EUR 2,880 before taxes. According to the latest Sodra data Vilnius residents earned, on average, EUR 2,604 per month before taxes in March.

Since the beginning of 2021, house prices in Tel Aviv have risen by 38%. Analysts at the international Swiss UBS Group estimate that house prices in the city have tripled in two decades, with the highest increase among the world’s 25 largest cities. In fact, according to a study by the financial consultancy firm Deloitte, Tel Aviv was the most expensive city in Europe in terms of the cost per square metre of housing in 2022, beating Paris. Tel Aviv is reportedly experiencing exceptionally high demand, limited supply and rising construction costs.

Tel Aviv figures are often combined with figures for the surrounding Central District, which is home to another 2.35 million people. This is an inflated figure, but it provides an overall impression. This is especially true considering that it borders the West Bank, a contested area with a great deal of turmoil, which makes it relevant in this context.

In the last quarter of 2023, housing transactions in the Central District decreased by 36.1% compared to the same quarter a year ago, with ‘only’ 12,250 units sold. The number of transactions in October was the lowest in a year, as the war broke out on 7 October following a terrorist attack. In December, sales recovered and according to a report by the Israeli Ministry of Finance, 6,088 units were sold, down 15% from the previous year but already 44.5% more than in November.

In January, housing transactions proliferated across Israel, one-third higher than the December result or the average for the previous month. The Chief Economist of the country’s Ministry of Finance stresses that the transaction contraction was temporary. In the Central District, the number of transactions in January was 62% higher than in January a year ago.

In Israel, the number of transactions in unfinished projects (‘off the drawing board’) is rising rapidly, especially after the Central Bank started to raise interest rates.

Seoul: less than 40 km from the border with the ‘country prison’ – North Korea

Seoul is one of the most densely populated cities in the world, with a high level of urbanisation. It is the economic, political and cultural centre of South Korea. This has led to a high demand for housing within the city limits, driven by inward migration, a strong labour market and good quality of life. However, in addition to its high population density, Seoul is geographically constrained by the mountains and the Han River, which limits development and puts exceptional pressure on the housing market.

Seoul is home to around 10 million people, compared to 26 million in the metropolis. However, the metropolis’s population density is 2,053 people per square kilometre, compared to 16,000 in the city. Seoul’s population has been declining recently due to the extremely high cost of housing, with people moving to neighbouring towns and regions, such as Incheon, another city in Gyeonggi Province, where housing prices are 64% lower.

Due to limited supply, high demand and speculative investment, residential property prices in Seoul have been high and have continued to rise. For example, Citus analysts say a square metre of housing in Seoul cost EUR 7,751.46 in January this year. In two years, it has increased in price by 17%, the same as the 38% increase in Tel Aviv since January 2020, and as much as 84% since the beginning of 2016.

Korean analysts note that residents and investors buying rental properties are seeking only new-build housing, as they believe it will continue to increase in price. They also argue that the supply of new-build housing will decrease simply because space will become scarce.

In truth, statistics on the South Korean housing market are difficult to find and analyse. An interesting example is that Koreans do not calculate the housing price per square metre but per unit, called a pyeong, which is 3.3 sqm.

In Seoul, people earn about the same as in Tel Aviv – around EUR 2,814 per month after taxes.

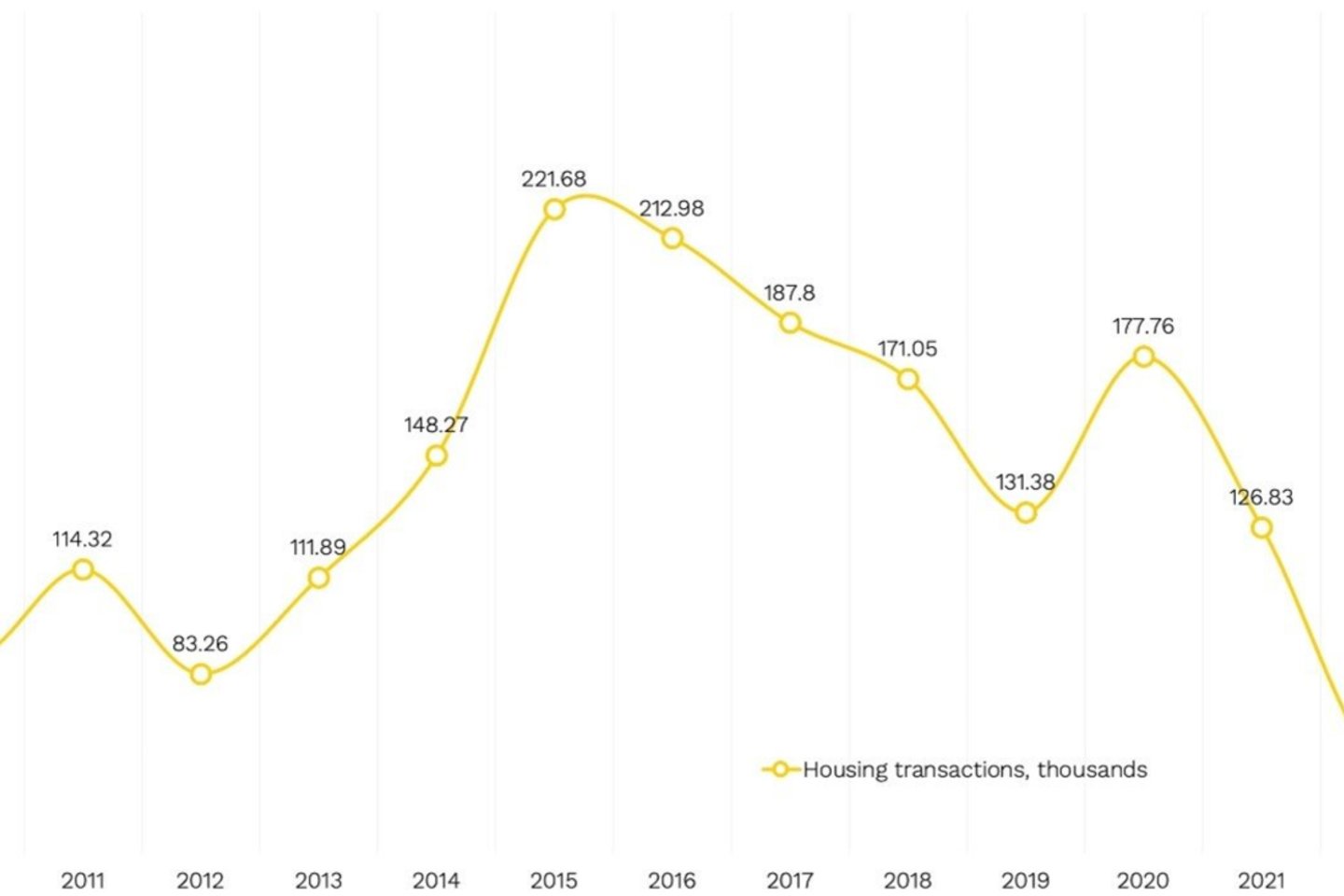

On average, more than 5,300 residential units were sold per month in Seoul in 2023, or about 64,000 units per year. This was about 15% more than in the previous year. The highest number of housing sales in Seoul in 2015 was around 220,000 yearly (or more than 18,000 monthly).

In South Korea, as in Lithuania, home ownership is perceived as a significant indicator of social stability and success, even though housing affordability in the country is one of the worst in the world.

Life flows at its own pace: Tel Aviv and Seoul are similar to Western European cities, while Lithuania is safe

These cities are comparable in some respects to Vilnius, although the differences are undoubtedly significant. However, the most fundamental fact is that the threats in these cities are apparent. Yet life goes on, and this enhances the economy and the country’s security: let’s not forget that the country’s national defence budget is a percentage of the GDP generated.

Despite decades of existential threat, these cities are also similar in many ways to other familiar European capitals and cities, where we would love to go and where we probably wouldn’t mind settling down either, such as Berlin, Stockholm, London, Amsterdam and Barcelona. I see very competitive housing markets, huge demand and high prices in these growing cities.

Lithuania ranks highest among its neighbours in the Institute for Economics & Peace’s annual Peace Index, scoring 73.58. Latvia scored 68.87, Estonia 70.28 and Poland 61.32. The World Bank rated our country’s political stability in 2022 as high at 79.6 out of 100. This reflects strong institutional capacity, legal efficiency and low levels of corruption.

We have secured long-term energy self-sufficiency and ecological transformation. We are prepared to prevent cyber threats: the International Telecommunication Union’s Global Cybersecurity Index ranks Lithuania 4th in Europe. We are continuously strengthening our national defence, cybersecurity and miltech capabilities. This is reflected in the steady growth of the Lithuanian defence sector: over the last five years, the number of employees has increased by 14% and revenues by 46%.

The fact that Lithuania is a member of NATO, the EU, the OECD, the WTO and a member of the Schengen Agreement is not even worth mentioning repeatedly. This shows Lithuania’s commitment to regional stability and cooperation.

We receive information through many channels, and it is essential to make the appropriate selection. I do not doubt that Lithuania’s security situation regarding direct military action is as stable as ever. And it is only continuing to improve. However, hybrid warfare, psychological and destabilisation operations are being carried out, and we have to be well aware of this. Our resistance to scaremongering determines whether we continue to be secure, whether we will remain calm, whether we will continue to live our lives and whether we will be creating prosperity and security.

In his 2016 book Those Who Remain: A Postapocalyptic Novel, the well-known writer G. Michael Hopf aptly described the cycle of civilisation: ‘Difficult times create strong people; strong people create good times; good times create weak people; and weak people create difficult times’.

I strongly believe that now is the time to be strong.